The Differences Between GST and SST

- Jun 8, 2018

- 2 min read

Our Malaysia GST to SST guide: Know what’s happening, understand the fears, and be prepared for the change from GST to SST which the 1st stage of implementation happening with zero-rated GST this June 2018.

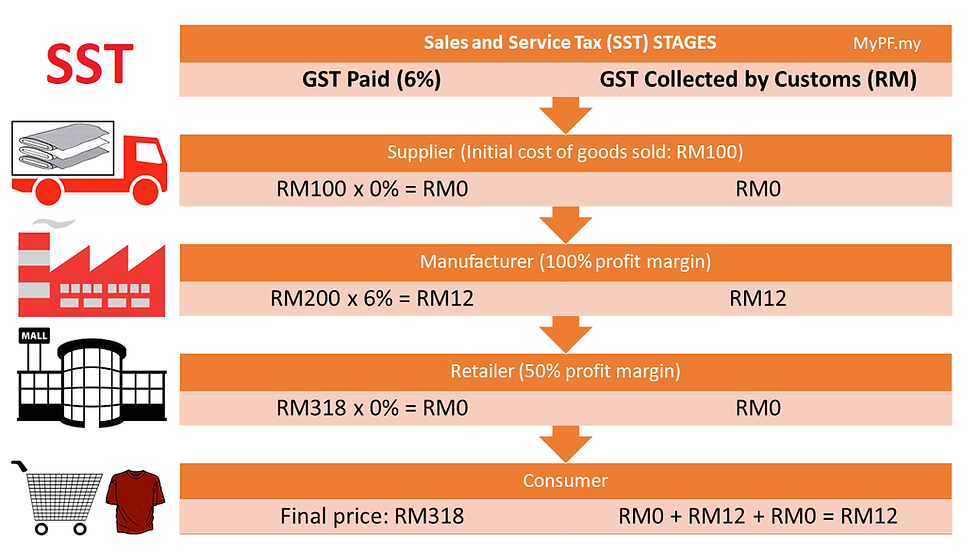

Goods and Services Tax (GST): is a tax on most products and services for domestic consumption at every level in the production process. GST can be claimed as input tax for companies with revenue above RM500k. GST was implemented in April 2015 replacing SST. GST is the most commonly used form of taxation used by 160 / 190 countries globally. GST is also known as Value Added Tax (VAT) in some other countries.

Sales and Service Tax (SST): are actually covered by 2 separate tax laws on a wide variety of goods and services at a single level implemented in 1970s. The Sales Tax Act 1972 is a single-stage tax charged typically at the manufacturer’s level. The Service Tax Act 1975 is a single-stage tax charged at the consumer’s level except at tax free zones. The sales tax was at 10% and service tax was at 6% respectively prior to being replaced by GST in 2015.

VS

What’s the hoohah on GST to SST?

The cancellation of GST is a key part of the new government’s election manifesto. Public opinion is generally that GST caused prices of goods and services in Malaysia to go up without the country seeing significant benefits to the additional tax revenue collected. A key question being asked is how will the change from GST to SST affect businesses as well as consumers?

Key GST to SST Changes

GST will be at 0% effective June 1, 2018.

GST act repealed July 16, 2018.

SST to be reintroduced on September 1 2018.

Tax shortfall estimated at RM25b.

Why 0% GST instead of GST being abolished

0% GST (zero-rated) will allow a smoother and lower cost transition from GST to SST.

Business owners still have six years to claim GST input tax (until GST fully abolished).

GST to SST Change Impact

GST to SST Collection Shortfall to be covered by:

Streamlining expenditure.

Trimming unnecessary discretionary spending.

Reviewing and prioritizing major projects.

Revamping and restructuring revenue generating non-financial public enterprises (e.g. Petronas).

Bank Negara Malaysia (BNM) (freemalaysiatoday.com)

Prices expected to drop without 6% GST.

Important for the relevant authorities to ensure that businesses pass lower cost benefits to the public.

Likely impact on inflation but too early to be calculated. Rates will be revised if needed.

Property Industry (REHDA) (theedgemarkets.com)

Property prices expected to drop.

Construction materials and costs should go down.

GST about 2-4% of costs.

Automotive Industry (PaulTan.org)

Car prices revised downwards without GST (and SST until reintroduced).

Some car makers and distributors will remain prices and refund difference if price goes down.

Longer term prices may go up slightly.

Other GST to SST Impact

0% GST and no SST from May 2018 until SST reintroduced on September 1, 2018.

Consumer products businesses (and stocks) expected to do well.

Cost of doing business will go down.

Reduced compliance cost of GST filing and penalties.

Potential downgrade in Malaysia’s credit rating.

(Short) delay in some spending until after GST zero rated.

What are your thoughts and queries on GST versus SST? Leave a message to discuss.

Comments